Black Friday 2025: 5 Steps to Holiday Shopping Budget Success

Is Your Holiday Shopping Budget Ready? Preparing your holiday shopping budget for Black Friday 2025 involves setting a total spending limit, creating a detailed gift list to estimate costs accurately, researching deals in advance to avoid impulsive overspending, automating savings to build funds, and regularly tracking expenses to stay within budget.

Are you ready to conquer Black Friday 2025 without breaking the bank? Planning your Is Your Holiday Shopping Budget Ready? 5 Steps to Finalize It Before Black Friday 2025 is crucial for a stress-free holiday season. Let’s dive into how you can prepare your budget and make the most of those deals.

Step 1: Set Your Total Holiday Shopping Spending Limit

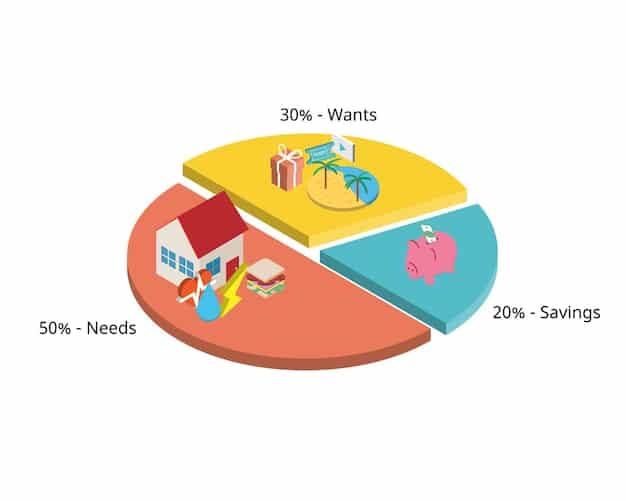

The first step in preparing your holiday shopping budget is to determine how much you can realistically afford to spend. This involves evaluating your finances and understanding your spending habits.

Setting a spending limit ensures you don’t overextend yourself financially during the holiday season. Consider your income, existing debts, and other financial obligations.

Assess Your Financial Situation

Start by reviewing your income and expenses. Identify areas where you can cut back temporarily to free up funds for holiday shopping.

Determine a Realistic Spending Limit

Based on your financial assessment, set a realistic spending limit that aligns with your budget. Avoid setting a limit that’s too high, which could lead to debt.

- Review your monthly income.

- List all your essential expenses.

- Calculate how much you can realistically allocate to holiday shopping.

- Set a firm spending limit and stick to it.

Setting a total spending limit is the foundation of a successful holiday shopping budget, providing a clear boundary to guide your purchasing decisions.

Step 2: Create a Detailed Gift List and Estimate Costs

Creating a detailed gift list is essential for staying organized and within budget. This step involves identifying everyone you need to buy gifts for and estimating how much you’ll spend on each person.

A gift list helps you to prioritize your spending and avoid impulse purchases, ensuring you allocate your budget effectively.

Identify Recipients and Gift Ideas

Start by listing all the people you plan to buy gifts for. Then, brainstorm gift ideas for each person, considering their interests and preferences.

Estimate Costs for Each Gift

Research the cost of each gift idea and estimate how much you’ll spend. Be realistic and factor in potential sales or discounts.

- List all family members, friends, and colleagues you plan to give gifts to.

- Brainstorm at least one gift idea for each person.

- Use online retailers or local stores to estimate the price of each gift.

- Total the estimated costs to see if it aligns with your overall spending limit.

By creating a detailed gift list with estimated costs, you gain a clear understanding of your spending needs and can make informed decisions.

Step 3: Research Deals in Advance to Avoid Impulse Overspending

Researching deals in advance is crucial for making informed purchasing decisions and avoiding impulse spending. Black Friday can be overwhelming, but preparation can make a significant difference.

By knowing what deals to expect, you can prioritize your shopping and avoid unnecessary purchases. This ensures you stay within your budget and get the best value for your money.

Identify Target Products and Retailers

Determine which products you want to buy and identify the retailers that typically offer deals on those items.

Track and Compare Prices

Monitor prices leading up to Black Friday and Cyber Monday. Use price tracking tools to compare prices across different retailers.

- Make a list of the specific products you plan to purchase during Black Friday.

- Identify the retailers that are likely to offer deals on those products.

- Sign up for email newsletters and follow social media accounts of retailers to stay informed about upcoming sales.

- Use price comparison websites and apps to track prices and identify the best deals.

Advance research allows you to make strategic decisions, ensuring you don’t fall victim to impulse purchases and stay within your holiday shopping budget.

Step 4: Automate Savings to Build Your Holiday Shopping Fund

Automating savings is an effective way to build your holiday shopping fund without actively thinking about it every day. Setting up automatic transfers from your checking account to a savings account can help you accumulate funds steadily.

This approach makes saving effortless and ensures you have the necessary funds when Black Friday arrives. Small, consistent contributions can add up over time.

Set Up Automatic Transfers

Arrange automatic transfers from your checking account to a dedicated savings account. Choose an amount you’re comfortable with and set the frequency to match your pay schedule.

Adjust Savings as Needed

Periodically review your savings progress and adjust the amount you’re saving if necessary. Consider increasing your contributions if you have extra funds available.

- Open a separate savings account specifically for holiday shopping.

- Set up automatic transfers from your checking account to your holiday savings account.

- Start with a small amount and gradually increase it over time.

- Monitor your savings progress and adjust your contributions as needed.

By automating savings, you can build a substantial holiday shopping fund without significant effort, helping you to meet your budget goals.

Step 5: Track Your Expenses and Stick to Your Budget

Tracking your expenses is essential for ensuring you stay within your holiday shopping budget. Regularly monitoring your spending allows you to identify potential overspending and make necessary adjustments.

This step provides valuable insights into your spending habits, helping you make informed decisions and avoid financial stress during the holiday season.

Use a Budgeting App or Spreadsheet

Utilize a budgeting app or spreadsheet to track your purchases. Record every transaction, including the amount spent and the item purchased.

Review and Adjust Regularly

Review your tracked expenses regularly to see how you’re progressing against your budget. Make adjustments as needed to stay on track.

- Choose a budgeting app or create a spreadsheet to track your holiday spending.

- Record every purchase, including the date, item, and amount spent.

- Categorize your expenses to identify where you’re spending the most money.

- Compare your actual spending to your budgeted amounts and make adjustments as necessary.

Regularly tracking your expenses provides you with the data you need to make informed decisions and adhere to your holiday shopping budget.

Additional Tips for Holiday Shopping Budget Success

Beyond the five main steps, there are several additional tips that can help you maximize your holiday shopping budget and enjoy a stress-free season.

These tips include exploring alternative gift ideas, leveraging rewards programs, and being mindful of shipping costs and return policies.

Consider DIY Gifts and Experiences

Instead of buying traditional gifts, consider creating DIY gifts or giving experiences. Homemade gifts can be thoughtful and cost-effective.

Leverage Rewards Programs and Discounts

Take advantage of rewards programs, credit card points, and discount codes to save money on your holiday purchases.

- Look for free events and activities in your area.

- Consider hosting a potluck dinner or game night instead of buying expensive gifts.

- Earn cashback or rewards points for your purchases.

- Use coupons and promo codes to save money on online and in-store purchases.

Implementing these additional tips can enhance savings and make your holiday shopping experience more enjoyable while staying within your financial means.

| Key Point | Brief Description |

|---|---|

| 💰 Set Spending Limit | Determine a realistic budget based on your finances to avoid overspending. |

| 📝 Create Gift List | List recipients and estimate gift costs to prioritize and prevent impulse buys. |

| 🔍 Research Deals | Track prices and identify discounts to ensure the best value for your money. |

| 🏦 Automate Savings | Set up automatic transfers to a savings account for a steady holiday fund. |

[Frequently Asked Questions]

▼

Start by assessing your financial situation, including income, expenses, and debts. Allocate a portion of your income that you can comfortably spend without causing financial strain. Consider setting aside a specific percentage of your monthly income for holiday shopping.

▼

If you exceed your budget, reassess your spending and identify areas where you can cut back. Consider reducing the amount you spend on certain gifts or experiences. Avoid using credit cards excessively, as this can lead to debt.

▼

Explore a variety of strategies to save money, such as researching deals in advance, using coupons and promo codes, considering DIY gifts, and taking advantage of rewards programs. Shopping early can also help you avoid last-minute impulse purchases.

▼

Consider giving experiences, such as tickets to a concert or a cooking class. Homemade gifts, like baked goods or handcrafted items, can also be thoughtful and cost-effective. Another option is to donate to a charity in the recipient’s name.

▼

Tracking your holiday spending is crucial for staying within your budget. It allows you to monitor your progress, identify areas where you may be overspending, and make necessary adjustments to avoid financial stress during the holiday season.

Conclusion

Preparing your holiday shopping budget for Black Friday 2025 doesn’t have to be overwhelming. By setting a spending limit, creating a detailed gift list, researching deals, automating savings, and tracking expenses, you can enjoy a stress-free holiday season without breaking the bank. Embrace these steps to ensure a joyful and financially responsible celebration.